31+ Taxes Calculator Alabama

Web Alabama Salary Tax Calculator for the Tax Year 202324. Web Use our easy payroll tax calculator to quickly run payroll in Alabama or look up 2023 state tax rates.

How To Calculate The Sales Tax On A Car In Alabama Ozark

Web The state income tax rate in Alabama is progressive and ranges from 2 to 5 while federal income tax rates range from 10 to 37 depending on your income.

. That means that your net pay will be 176277 per year or 14690 per month. Calculate your 2023 Alabama state income taxes. Web The Alabama Salary Calculator is a good tool for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2024 and Alabama State Income Tax Rates and Thresholds in 2024.

Web The new FAFSA form will significantly improve streamline and redesign how students and their families use the form. Web If you make 130000 a year living in the region of Alabama USA you will be taxed 37036. That means that your net pay will be 43658 per year or 3638 per month.

This marginal tax rate means that. That means that your net pay will be 92964 per year or 7747 per month. Your average tax rate is 285 and your marginal tax rate is 355.

Updated on Jul 18 2023. This is only a high level federal tax income estimate. Web Paycheck Calculator Alabama-AL Tax Year 2023.

Start free and prepare a current tax year federal and state income tax return for exact results. Web The Alabama Income Tax Calculator is a powerful tool designed to help individuals and businesses in Alabama estimate their state income tax liability. Use the Alabama salary paycheck calculator to see the amount of Alabama income tax you will pay per paycheck.

Web If you make 55000 a year living in the region of Alabama USA you will be taxed 11342. To estimate your tax return for 202425 please select the 2024 tax year. Our calculator has recently been updated to include both the latest Federal Tax Rates.

Use ADPs Alabama Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Last Updated on December 05 2023 Alabama State charges 2 to 5 of tax on your income. Alabamas income tax are progressive meaning higher earners will be subject to higher income tax rates.

Web The Alabama State Tax Calculator ALS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202425. Web Estimate my Federal and State Taxes. You can quickly estimate your Alabama State Tax and Federal.

Details of the personal income tax. Web The total income tax is 9710 for a single filer. Estimate your tax liability based on your income location and other conditions.

This paycheck calculator can help estimate your take home pay and your average income. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest. The Federal or IRS Taxes Are Listed.

The after-tax income is 38290. To estimate your tax return for 20232024 please select the 20232024 tax year. If you make 260000 a year living in the region of Alabama USA you will be taxed 83723.

Your average tax rate is 206 and your marginal tax rate is 336. Use our paycheck tax calculator. These rates vary by location and may affect your take-home pay.

You are able to use our Alabama State Tax Calculator to calculate your total tax costs in the tax year 202324. Web The Alabama State Tax Calculator ALS Tax Calculator uses the latest Federal tax tables and State Tax tables for 2023. Web The rates range from 2 to 5 based on income levels.

While theres no state payroll tax some cities in Alabama do have local income taxes deducted from your paycheck. Web Alabama Paycheck Calculator. Web If your gross pay is 5300000 per year in the state of Alabama your net pay or take home pay will be 41235 after tax deductions of 2220 or 1176502.

Your average tax rate is 322 and your marginal tax rate is 398. For the first time applicants will be able to securely transfer their federal tax information necessary for the eligibility calculation directly from. Deductions include a total of 1 868 or 460050 for the federal income tax 2 587 or 311002 for.

Besides up to 2 will also be charged on your gross wage as occupational taxes depending on which. Web Yes Alabama residents pay personal income tax. Web The Alabama Tax Calculator Lets You Calculate Your State Taxes For the Tax Year.

Web Alabama Paycheck Calculator For Salary Hourly Payment 2023 Curious to know how much taxes and other deductions will reduce your paycheck. With its user-friendly interface and easy-to-use features this calculator provides accurate and reliable.

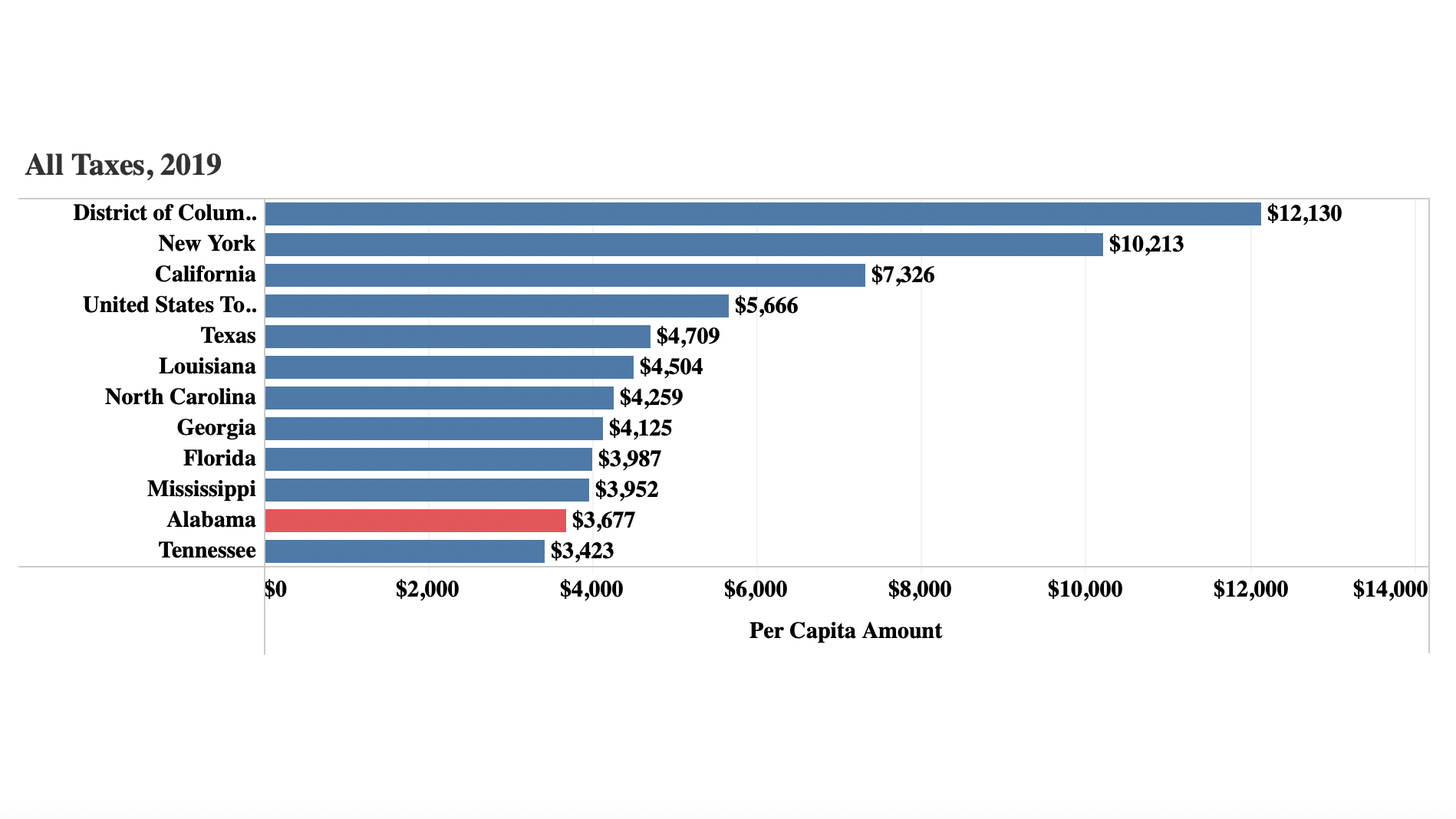

Parca Report Shows Alabama Has Nation S Second Lowest Tax Collection Per Capita

Pdf Healthy Nudged And Wise Experimental Evidence On The Role Of Information Salience In Reducing Tobacco Intake

Alabama Tax Calculator

I Was Born On 30 10 2002 At 1 50 Am At Rudrapur Deoria Up Is There A Love Marriage Then With My Current Partner Quora

Volume 4 Issue 2 June 2012 Ozean Publications

What Is The Alabama Standard Deduction For 2022 Support

Alabama Salary After Tax Calculator 2024 Icalculator

Alabama Salary After Tax Calculator 2024 Icalculator

Lbcinvestorpresentation

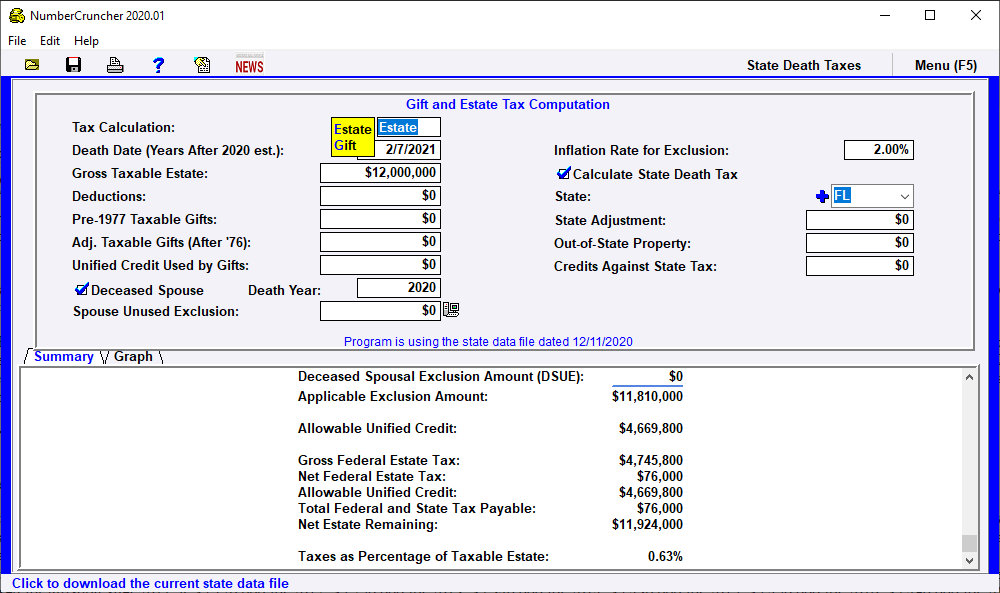

Estate Tax Gift And Estate Tax Computation Leimberg Leclair Lackner Inc

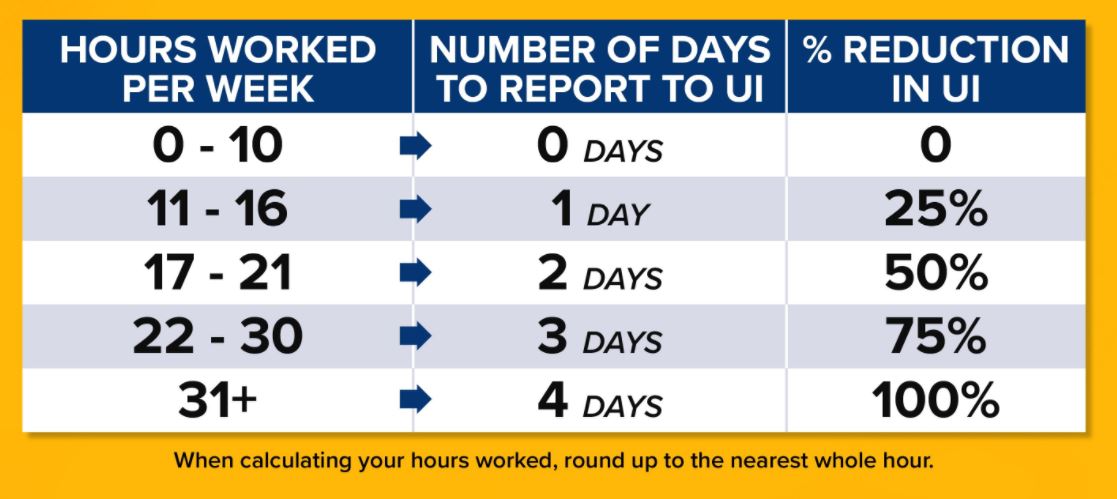

Ny Partial Unemployment Now Based On Hours Worked Not Days Homeunemployed Com

Unidokkan Mods

Tax Haven Wikipedia

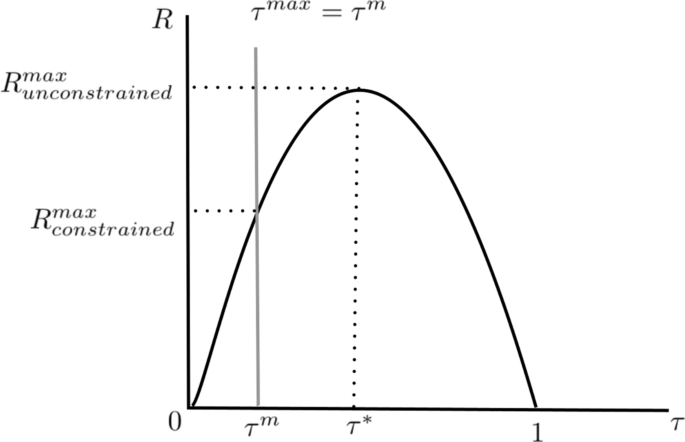

Natural Amenities And Neo Hobbesian Local Public Finance Springerlink

Pdf Predicting Intentional And Inadvertent Non Compliance Ju Sung Lee Academia Edu

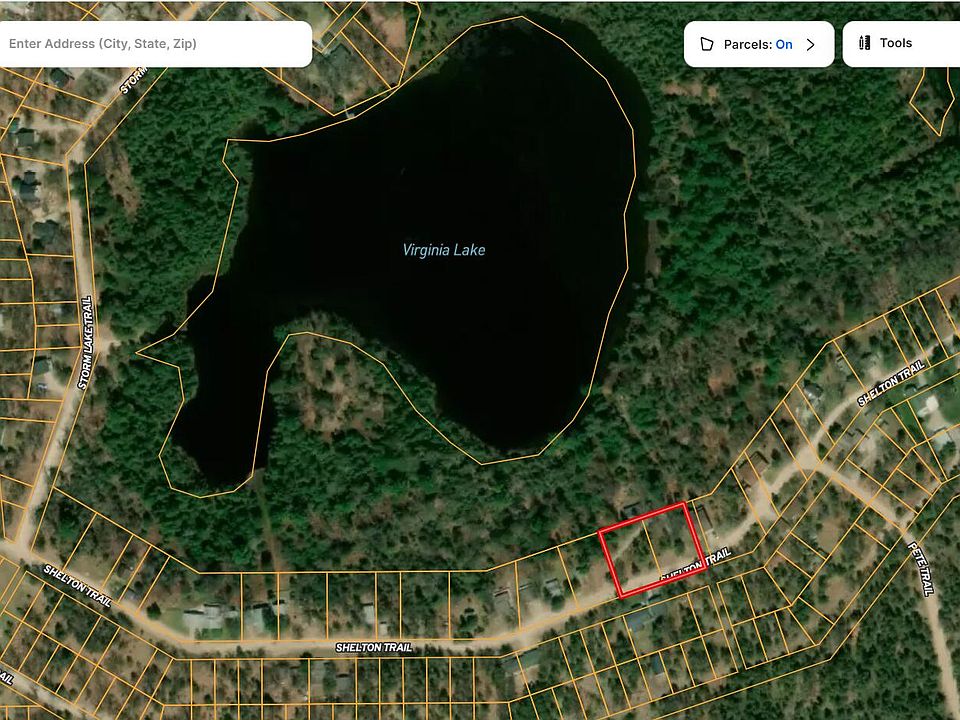

22269 Shelton Rd Atlanta Mi 49709 Zillow

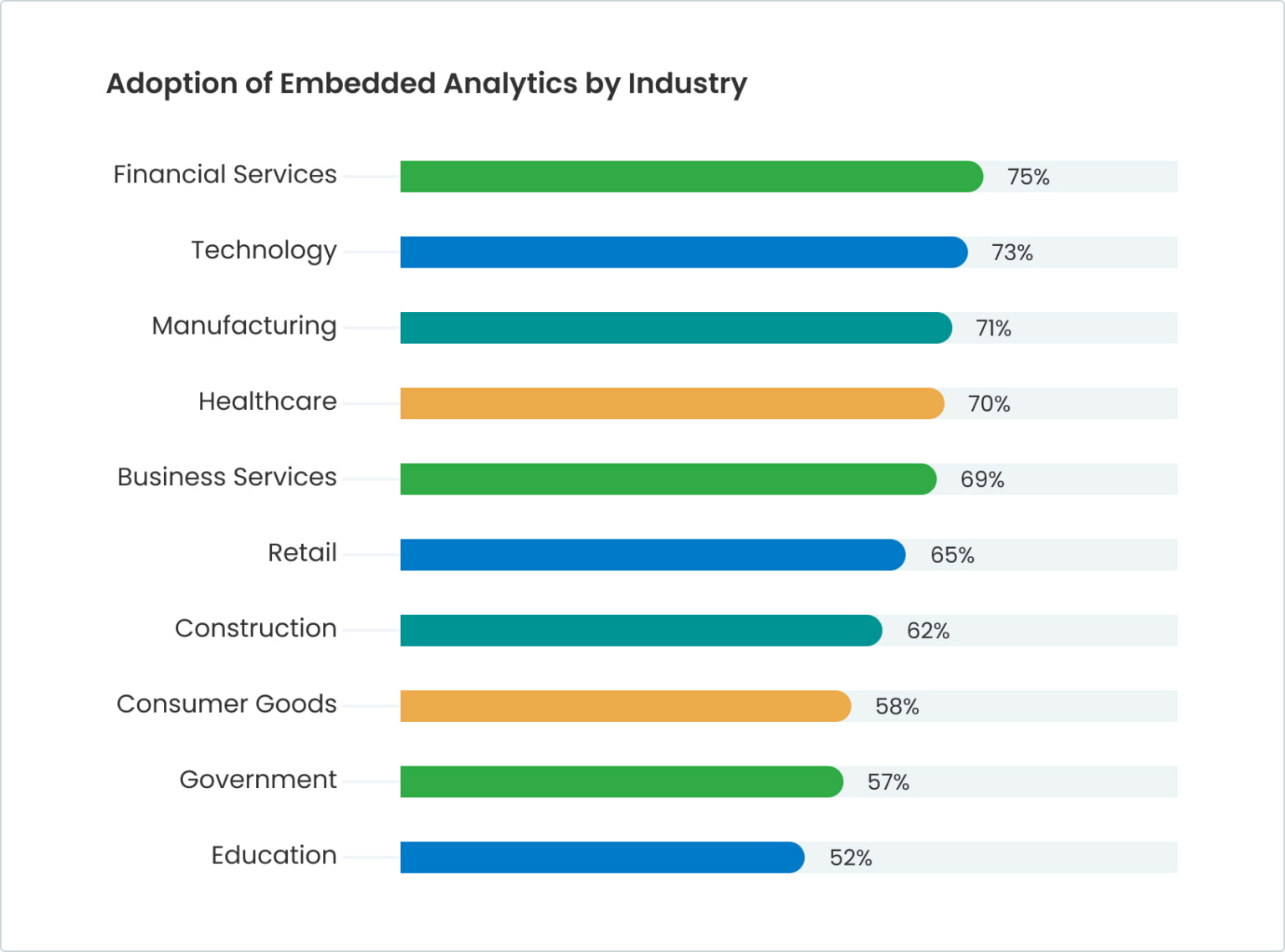

What Is Embedded Analytics Insightsoftware